Extracted from the 2024 Phnom Penh Real Estate Market Report by POINTER.

Phnom Penh’s real estate market in 2024 presents a landscape of evolving trends and significant opportunities, influenced by economic shifts, infrastructure development, and changing investor dynamics.

Economic Overview

Cambodia’s economy continues its recovery trajectory with projected GDP growth of 5.8% in 2024, driven by increased trade partnerships within ASEAN and beyond. Inflation has significantly decreased from its 2022 peak of 5.3% to just 0.5% in 2024, indicating successful economic stabilization efforts.

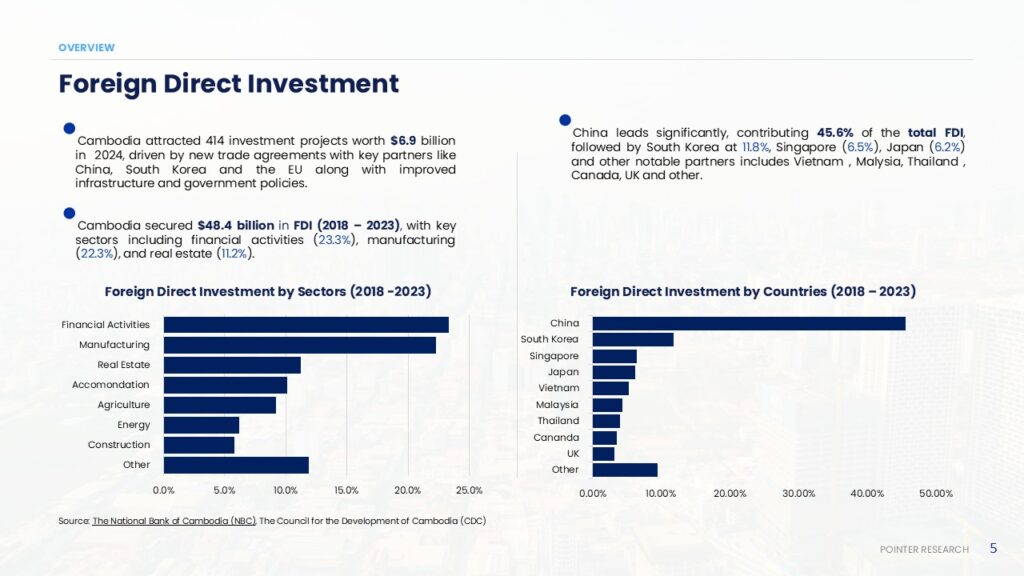

Foreign Direct Investment (FDI)

Cambodia attracted 414 investment projects totaling $6.9 billion in 2024. China remains the largest investor, followed by South Korea and Singapore. Real estate continues to be a key sector, representing 11.2% of total FDI from 2018 to 2023.

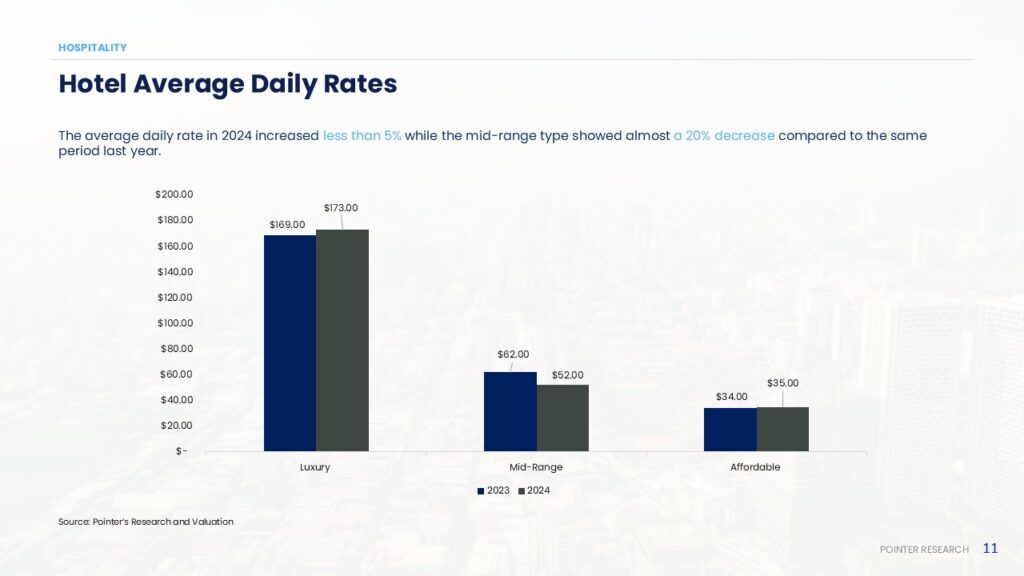

Hospitality Sector

The hospitality market in Phnom Penh saw modest expansion, with three major hotel projects completed in 2024, including notable developments such as the Radisson Red and Novotel. The total hotel room supply reached 14,318, a slight increase from 2023. Although average daily rates (ADRs) experienced modest growth, mid-range hotel rates dropped significantly by nearly 20%, reflecting competitive pressures and shifting demand.

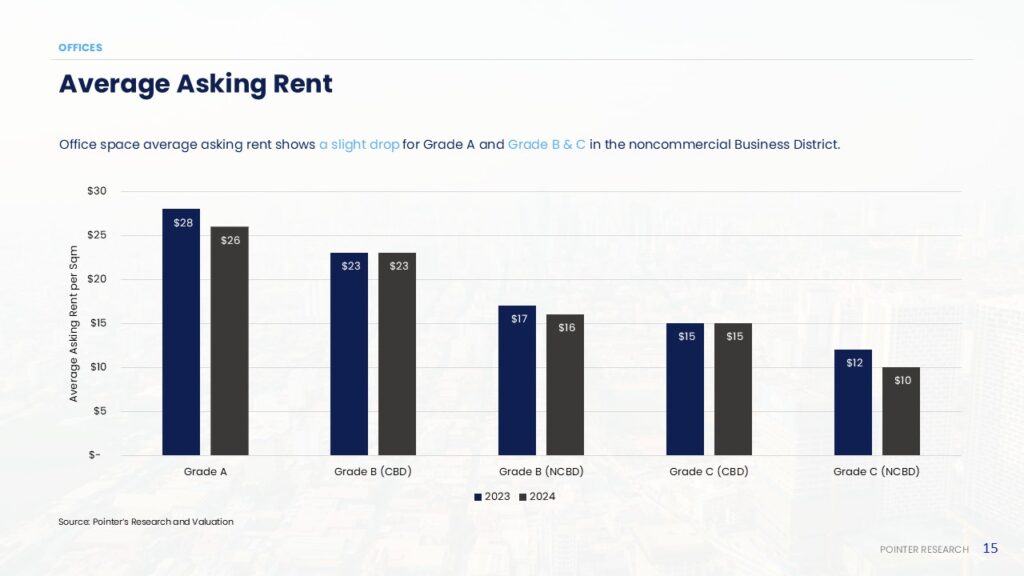

Office Market Dynamics

Phnom Penh’s office market grew by 12%, adding approximately 100,000 sqm of office space. Newly completed projects like Maritime Tower and Connexion signal growing commercial infrastructure. However, rental prices for Grade A, B, and C offices declined slightly, indicating supply outpacing demand. Future outlook suggests continuous growth, supported by SME expansion and increasing foreign investments, particularly concentrated in the districts of Chamkarmon and Daun Penh.

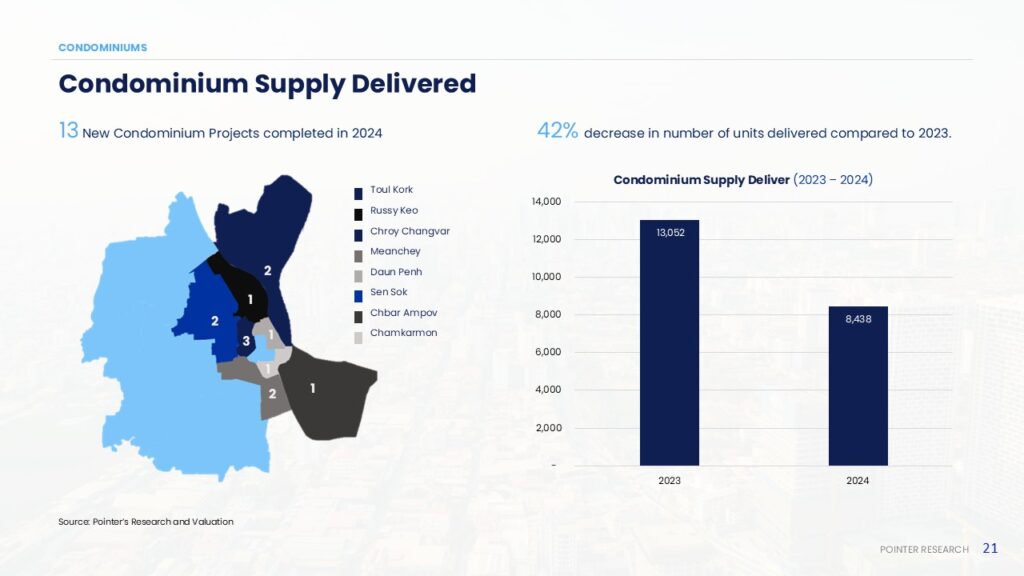

Condominium Trends

The condominium market experienced a notable slowdown in new unit deliveries, dropping by 42% compared to 2023. Despite fewer units, mid-range condominiums remain attractive to local buyers due to affordability and flexible payment options. High-end units attract international buyers but show comparatively less activity. New project launches such as Picasso Sky Gemme and Time Square 7 are set to balance market dynamics through their reputable developers and prime locations.

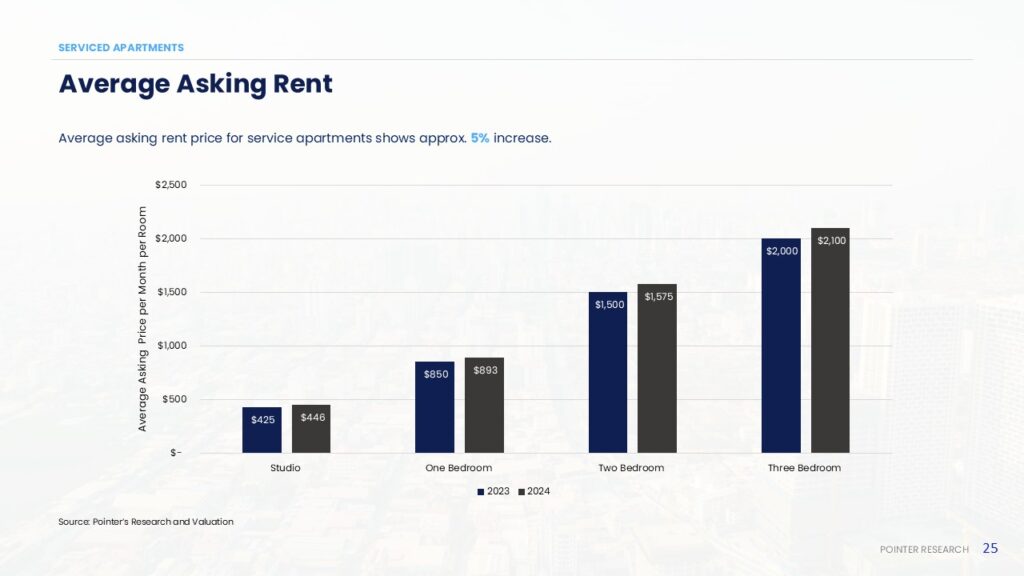

Serviced Apartments

With approximately 6,000 units in the market, the serviced apartment sector saw minimal growth, primarily due to delayed construction projects. Average rents showed around a 5% increase year-over-year, reflecting stable demand concentrated within central city districts such as Boeung Keng Kang and Chamkarmon. The upcoming year expects an additional 600 units entering the market, further stabilizing supply-demand equilibrium.

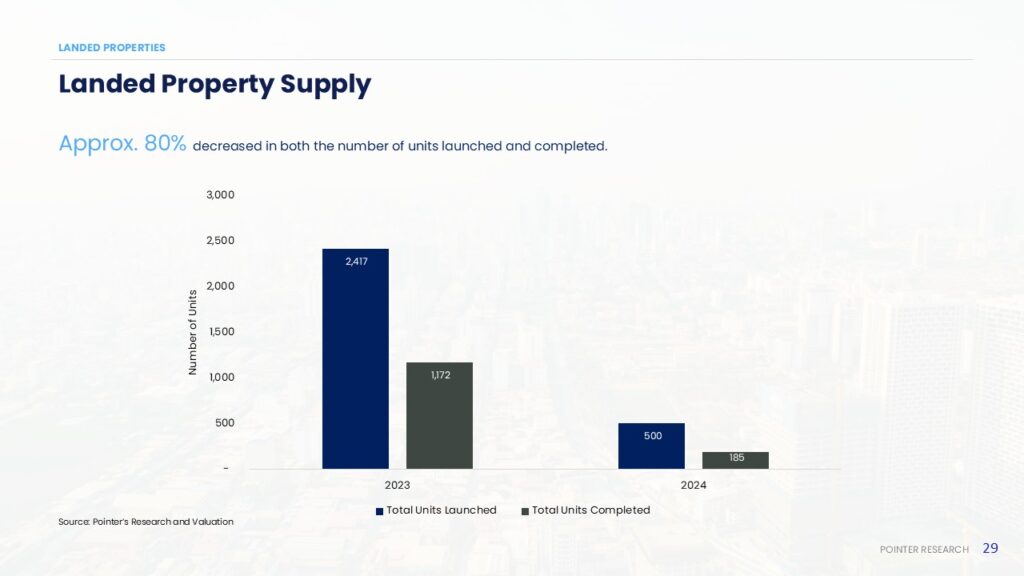

Landed Properties

Landed property markets witnessed significant contraction, with an 80% reduction in new unit launches and completions compared to the previous year. Despite this slowdown, strategically located projects in southern Phnom Penh, bolstered by new infrastructural developments such as the Koh Pich-Koh Norea Bridge, continue to draw buyer interest, positioning them for appreciation in value.

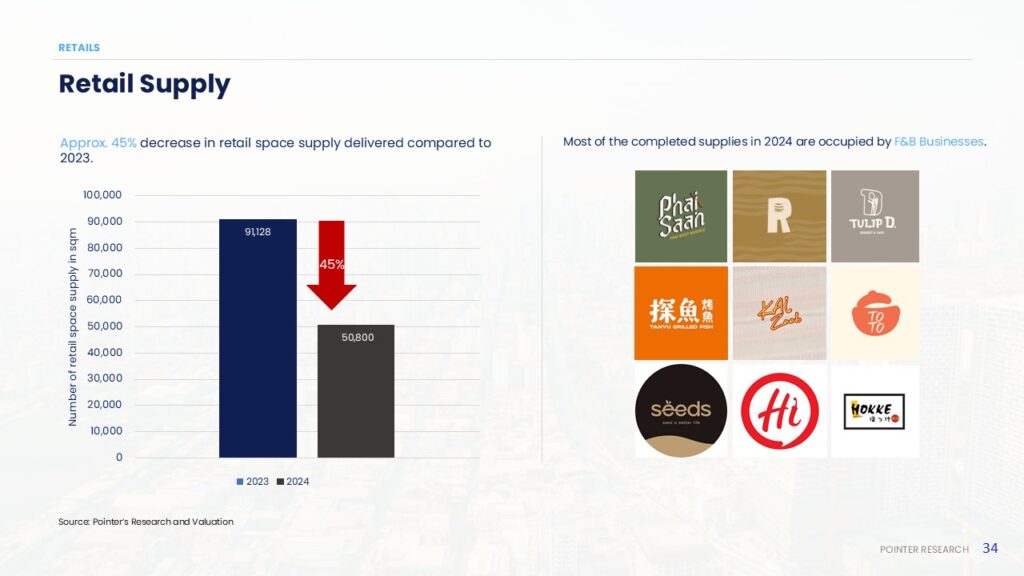

Retail Market

Retail space supply reduced significantly by 45% compared to 2023. New retail concepts, particularly mixed-use developments such as Riverlight Koh Norea, have attracted consumer interest. The average rental rate stabilized around $25 per sqm, with consumption trends primarily focused on food and beverages, health, lifestyle, and household goods. Upcoming developments promise additional growth in 2025.

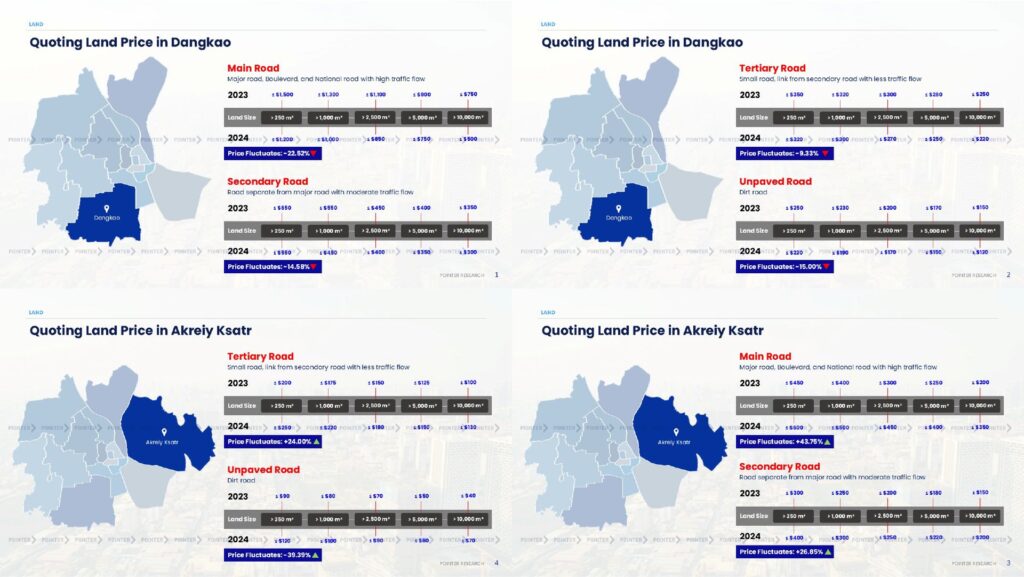

Land Market Developments

Land prices in notable Phnom Penh districts such as Dangkao, Meanchey, Chbar Ampov, and Akreiy Ksatr exhibited varied trends. Most areas saw moderate price declines; however, Akreiy Ksatr displayed remarkable price increases (up to 43.75% on main roads), underscoring its potential for significant future growth due to improved connectivity and affordability.

Future Outlook

Phnom Penh’s real estate market in 2024 clearly demonstrates adaptability and resilience amid shifting economic conditions. Hospitality and retail sectors anticipate recovery aligned with tourism resurgence and consumer spending. Office and condominium markets face oversupply risks but are buoyed by foreign investment and local demand. Landed properties and emerging land markets like Akreiy Ksatr represent strategic long-term investments.

Investors and stakeholders navigating this dynamic landscape must consider evolving market needs, infrastructure growth, and economic indicators to capitalize effectively on Phnom Penh’s continued urban development and expansion.

For the full detailed report, please visit https://pointerasia.com/real-estate-market-report/.